We hope you are having a prosperous 2022. The beginning of a new year always brings the anxiety and stress of getting year-end reporting done for the previous year. CarrierNet wants to help make the process as easy and understandable as we can for you, our valued clients.

Our Reports

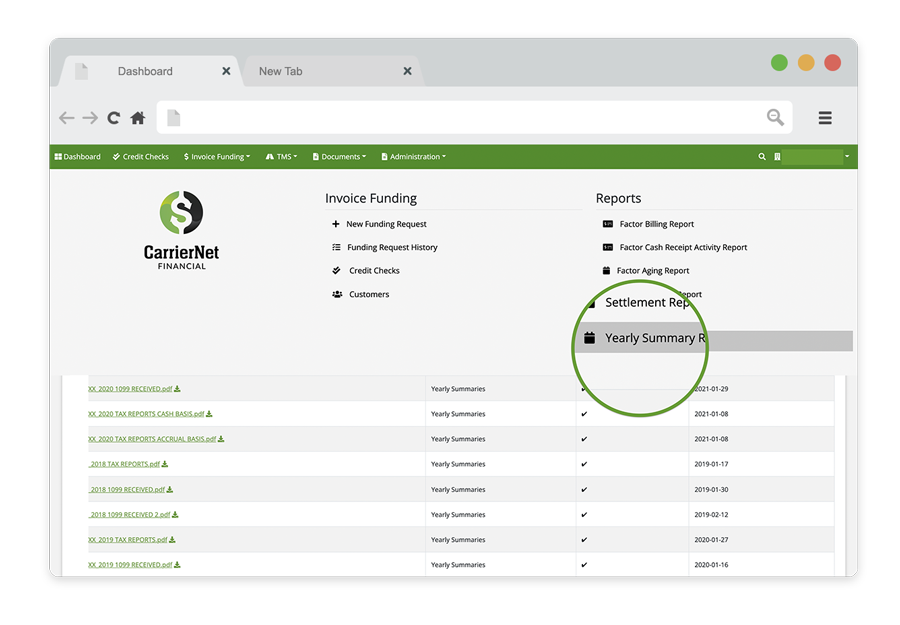

We have put together some year-end reports that you can use to report your revenue and/or expenses for year-end reporting purposes. You will want to visit with your tax preparation specialist or CPA on which one of the two options is the best fit for you. There are two different reporting methods for your viewing, Cash Basis and Accrual Basis.

Cash Basis Tax Report

Cash Basis is the easiest of the accounting methods. Cash-basis accounting only lets you use cash accounts to track and record transactions. You can record things like cash, expenses, and income with the cash-basis method, but you cannot track long-term liabilities, loans, or inventory. The ‘Cash Basis Tax Report’ shows all cash revenue you (the carrier) received from CarrierNet as payments. You will not need adjustments, fees, or reserves reported for this method as all adjustments and fees are taken out prior to the cash deposit.

Accrual Basis Tax Report

Accrual accounting is the most complex accounting method available. It is the only method accepted by GAAP (Generally Accepted Accounting Principles). Generally, you must have some accounting knowledge to use accrual-based accounting. Unlike cash basis, you will need your deductions reporting for fees and adjustments for bad debts (if any). The ‘Accrual Basis Tax Report’ breaks out all your revenue and deductions for you. It will show you detailed information on what was billed (your revenue), any adjustments on your cash receipts, and any fees you incurred (deductions).